Import & Export Consultancy Services:

We are planning to establish a new wing called import and export services in our

business. At present our area of expertise binds in doing consultancy services. We

give suggestions to our clients for better import and export within the schedule and

investment plans. We are also focusing on how to get financing facilities and make

them aware of pros and cons of international trade system. We support our clients

by analyzing their requirements and make them aware of international trade risk.

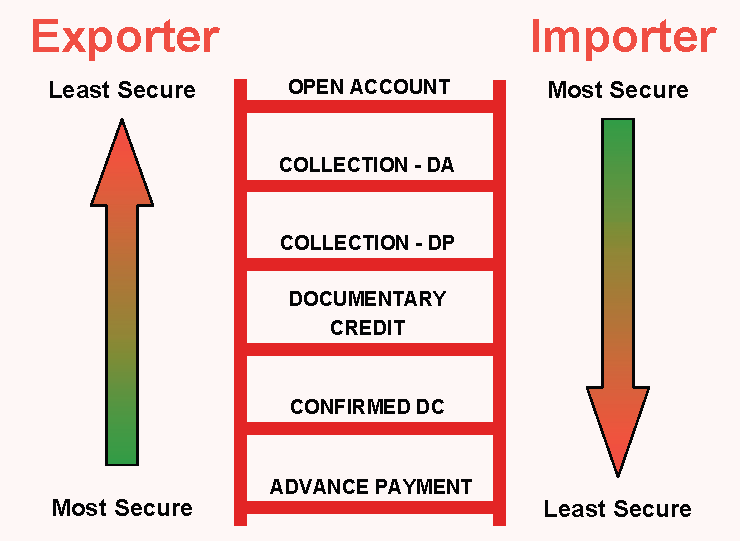

The Risk Ladder

The risk ladder below illustrates the way in which the payment mechanism can affect the parties’ security.

Import Finance

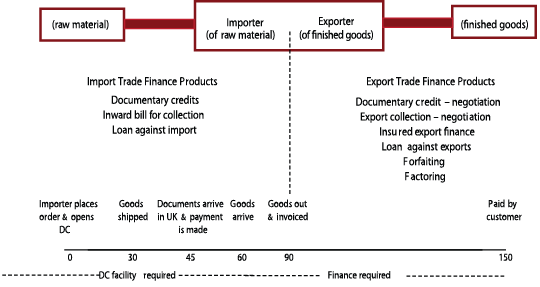

The time between placing an order for goods and receipt of the cash in respect of

their subsequent resale can put a significant strain on an importer’s resources.

Seasonal peaks, long transit times and lengthy credit terms all add to the demands

on the importer. It is important that the finance to meet these fluctuations in the

importer’s working capital requirements is geared to the terms and method of

payment agreed between buyer and seller. This may require a combination of

facilities. For example, documentary credit facilities might be required to cover the

pre-shipment period whilst post-import finance can be obtained through an import

loan.The diagram below is a simple illustration of the trade cycle of a company which

both imports and exports. Clearly every company will have their own unique

requirements.

Export Finance

Financing the post-manufacture/sale period is an important consideration for any exporter.

Most exporting companies sell their goods on terms which typically do not exceed 180 days

and where the payment mechanism will vary from Open Account through Bills for Collection

to irrevocable Documentary Credit. With longer term transactions, secure payment

mechanisms are usually demanded by the seller.Financing export receivables separately from other short term cash requirements makes

tracking export-related debts simpler and, by having an identified source of repayment,

banking facilities can become more accessible.

Whilst some facilities are undertaken with recourse to the exporter, transactions covered by

credit insurance or where payment is made via Documentary Credit may be suitable for

non-recourse financing.

The method chosen will be influenced by a number of factors:

- The terms of trade

- The payment mechanism

- The availability of export credit insurance

- Currency and Cashflow considerations

Factoring

Finance for export receivables as well as local sales can be provided by a factoring company

who will purchase trade debts for cash providing the exporter with immediate cashflow.

Usually a maximum of 80% of the invoice value is paid immediately upon presentation of

invoices with the remainder becoming available as soon as payment is received from the

buyer.

Forfaiting

The term ‘forfaiting’ is derived from the French à forfait which means to surrender or

relinquish the rights to something. In return for a cash payment from a forfaiter, an exporter

agrees to surrender or relinquish the rights to claims for payment on goods or services

delivered to a buyer.

Finance under Documentary Credits

There are several ways in which an exporter can obtain finance under a DC, each depending

upon how the DC is payable. Finance under DCs is usually based on inter-bank rates which

will be fixed and at a finer rate than other forms of finance such as bank overdraft.There are two ways in which pre-shipment finance can be raised from a documentary credit.

The simplest is for the DC terms to include a clause (known as a ‘red clause’) permitting an

advance of funds to the beneficiary (exporter) prior to presentation of the shipping

documents. In this way, the importer directly finances the exporter.