Eexport Import

The Importance Of Documentation:

Documentation provides tangible evidence that the goods ordered have been

produced and dispatched in accordance with the buyer’s requirements.

Consignment details need to be communicated accurately to various parties

so both importers and exporters need to be familiar with the principal

documents used. Documentation is also used to satisfy government

regulations in the UK and overseas and has become an increasingly important

factor in obtaining finance for international trade.

It is normally the responsibility of the exporter to make sure that documents

for the transportation of goods are complete, accurate and properly and

promptly processed. Failure to do so may result in additional costs being

incurred.

The importer has the responsibility for completing accurately the necessary

forms for the goods to be licensed for import and cleared through Customs.

Incorrect documentation can cause delay in the clearance of goods at their

destination. Goods can be impounded, warehoused or left on the quayside,

with the risk of damage or loss and consequent expense. The use of a

forwarding agent can help reduce administrative and documentation pressures

on importers and exporters.

Financial Documents:

The principal financial documents used in international trade are described

below.

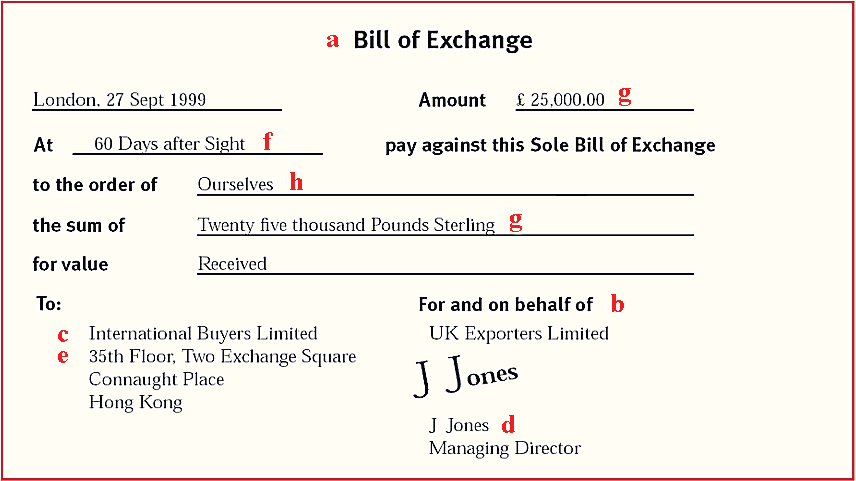

Bill of Exchange:

A bill of exchange, or draft, is used to establish a legal commitment to pay a

sum of money. It also provides a convenient mechanism for the giving or

receiving of a period of credit.

- A 'sight' bill is payable on demand, or at sight.

- A ‘term’ bill or ‘usance’ bill is payable at a fixed or determinable future

time. The drawee agrees to pay on the due date by writing an

acceptance across the face of the bill.

A bill of exchange is usually defined as:

- An unconditional order in writing

- Addressed by one person (the drawer) to another (the drawee)

- Signed by the person giving it (the drawer)

- Requiring the person to whom it is addressed

- To pay on demand, or at a fixed or determinable future time

- A sum certain in money

- To, or to the order of, a specified person or to bearer (the payee)

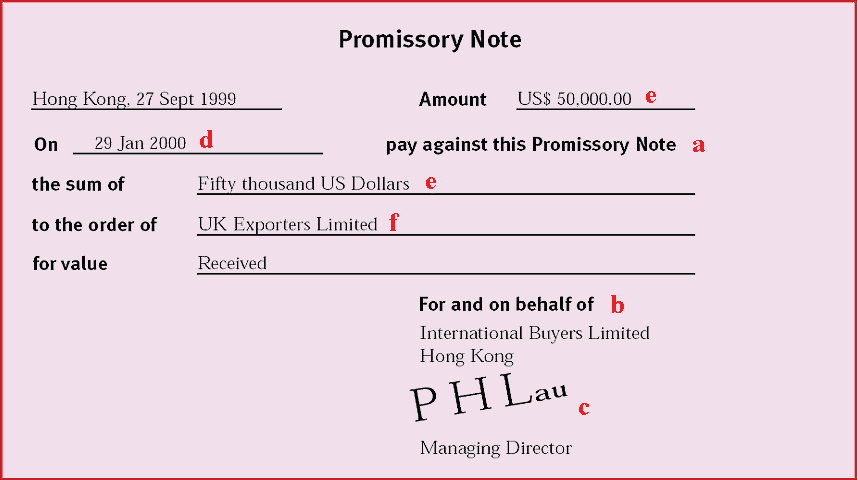

Promissory Note:

A promissory note is a promise to pay issued by the buyer (the maker) in

favour of the seller (the payee or beneficiary). Although it is similar to a bill

of exchange it does not always carry the same legal rights. Promissory notes

are popular in forfaiting arrangements and with countries where there is some

fiscal reason for not issuing a bill of exchange.

A promissory note is usually defined as:

- An unconditional promise in writing

- Made by one person (the maker) to another

- Signed by the maker

- Engaging to pay, on demand, or at a fixed or determinable future time

- A sum certain in money

- To, or to the order of, a specified person or to bearer (the payee or

beneficiary)

Most bills of exchange and promissory notes are now generated by computer

or printed on company stationery, although they can still be purchased from

commercial stationers. They vary in shape, size and layout, but the above

example is fairly typical.

If the bill is payable to the drawer’s own order, as in this example, it must be

endorsed on the reverse before presentation to the bank. The endorsement can

be ‘in blank’ or specifically to the order of the bank handling the documents

on the drawer’s behalf.

When presenting documents under a documentary credit (DC), the bill of

exchange must be drawn on the party nominated in the DC terms as drawee

(usually the issuing or confirming bank). The DC terms may also stipulate

that the bill of exchange bears reference to the DC, e.g. is marked ‘Drawn

under documentary credit number ........... of (issuing) bank.

Fraud Warning:

The importance of ensuring our customers know their customers cannot be over-emphasised; it is the best

protection against fraud. Unfortunately there have been instances where forged documents or documents

relating to non-existent goods have been presented to banks under Documentary Credits and, since the

documents appeared prima facie to comply with the terms and conditions of the Documentary Credit, banks

have been obliged to pay and debit the importer’s account. This arises because banks deal with documents, not

with the underlying goods.

Exporters should be extremely cautious about shipping goods against the receipt of an unsolicited

Documentary Credit. From time to time, forgeries of Documentary Credits come to light and there have been

instances where exporters have shipped and presented documents against a completely false instrument.

Importers and exporters should be particularly careful about proposals to transact international trade business

which is markedly different from their normal line of business or for unusually large amounts. There have been

cases where fraudsters have obtained advance payments from UK traders in the expectation of the award of a

contract which never really existed.